Work for a Credit Union, a Bank or own a Professional Service Business? Feel like you are being targeted by lawsuits regarding the usability of your spaces, websites or technology in general? You are… systematically, and it is getting worse. Welcome to the wild world of ADA Lawsuits.

For those of you catching up we’ll save you the google trip. The ADA in this case stands for the “Americans With Disabilities Act”. It is legislation passed in 1990 that prohibits discrimination against people with disabilities. Under this Act, discrimination against a disabled person is illegal in employment, transportation, public accommodations, communications and government activities. The sticky part for most FIs (financial institutions) and businesses is centered around the term “public accommodations”.

Here is a quote from the CUNA (Credit Union National Association) web site:

“Credit unions across the country have been threatened with predatory litigation from certain plaintiffs’ law firms seeking to profit from ambiguities in requirements for website accessibility under the Americans with Disabilities Act (ADA). While the ADA is important and necessary for the well-being of those protected by it, plaintiffs’ lawyers are exploiting compliance ambiguities to the detriment of all credit unions members.”

In plain English this means Credit Unions (as well as banks and other high value businesses) have been the target by unscrupulous organizations that, under the guise of helping the disabled, are “casing” organizations and filing lawsuits to profit by. In these cases the plaintiff is a paid envoy of the legal group that is obligated to turn any financial settlements or damages over to the predatory organization. FIs and businesses are in some cases getting litigation letters with requirements to be in compliance within two weeks, only to find the complaint has already been filed in court.

I think we can all agree that this is less than cool. These laws were enacted with the good intention of helping the disabled win a foothold in a world, that for many reasons, overlooks the varied needs of the disabled. The unfortunate result of the unfinished work of the ADA has been a lack of clarity about what falls into the jurisdiction of public accommodation (websites for example) and what it means to fix compliance issues in a way that is readily achievable – meaning easily accomplishable and able to be carried out without much difficulty or expense.

All too often, especially when it comes to technology-based accommodations, what is readily achievable often comes with a laborious retrofit cost. This often leaves a business, financial or otherwise, evaluating the risk of litigation vs. the cost of implementing ADA to every technology that may be considered a public offering. Furthermore, many businesses we see facing these lawsuits really want to do the right thing for disabled customers. What they are seeking is a clear set of requirements to meet, and a way to protect themselves from predators while they make needed changes.

Now, before we go any further we need to clearly disclose that The Kiosk and Display Company, LLC is not a legal firm. We are not qualified to give legal advice or assess your risk of getting sued about ADA requirements or anything else in the legal realm. Kiosk and Display is a full service interactive digital signage agency serving banks and credit unions as well as professional service businesses and manufacturers. Our primary products include digital signage and interactive touchscreen kiosks.

What we can tell you is that our U.S. based customers are having many conversations around balancing the costs of being fully ADA compliant and the risk of being sued. This is because there is no one-size-fits-all answer to ADA compliance. As we learned from Michelle Anderson Fisher Phillips, whose firm Fisher & Phillips LLP specializes in workplace law, “Title III of the ADA focuses on accommodations that are readily achievable.” said Michelle. “Generally, that comes down to what it will cost to implement the accommodation in context of the financial resources of the place of public accommodation.” This can make it tricky to clearly understand the level of accommodation required to do the right thing for disabled customers and maintain a fiscal balance that does not threaten the solvency of the business. Credit Unions, Banks and Professional Service Business are right to turn to their peer-based organizations such as CUNA, ABA and the SBA for experience and legal advocacy.

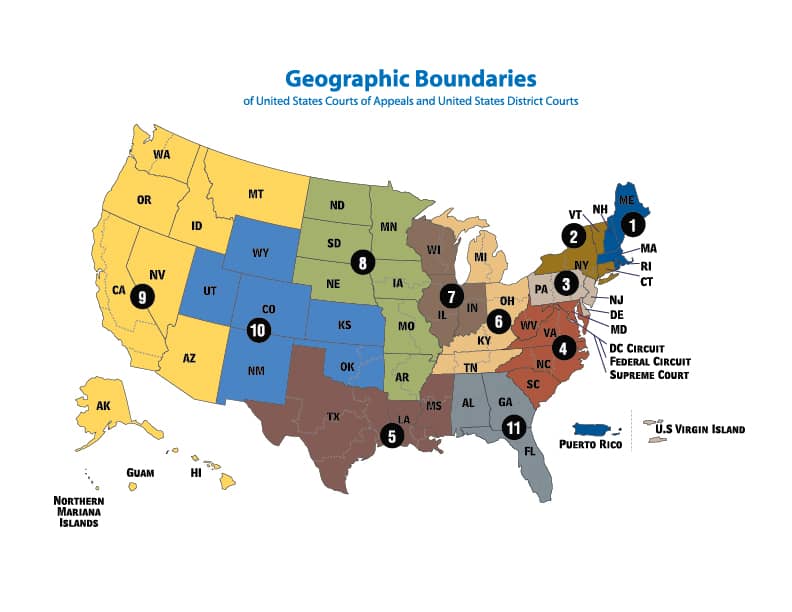

We also don’t envy the lack of clarity our customers face. According to Michelle’s presentation we saw at the 2018 CUNA Marketing Conference called “ADA Lawsuits: What Every Marketer Needs to Know.” there remains a lack of guidance from the DOJ (Department of Justice) on the enforcement of the ADA and court cases being brought forth. There is currently regional disagreement in the courts depending on a businesses location. Courts in the 1st, 2nd and 7th Circuits think a website is a public accommodation and subject to ADA guidance, while the Courts in the 3rd, 6th, 9th and 11th Circuits think a website is NOT a public accommodation, unless, the website is heavily integrated with the brick-and-mortar stores and operates in many ways as a gateway to the stores (9th circuit) or the website has a nexus with the physical location (6th and 11th circuits). If you are located in the 4th, 5th, 8th and 10th circuit there is insufficient case law to go by.

What can business do to protect themselves from litigation and support the disabled?

If you already have all the physical requirements met as outlined in the ADA’s small business compliance site then the next step to reduce risk is to consider tackling your web site and supporting touchscreen kiosks if you have them.

We know from the article “Avoiding the Website Accessibility Shakedown” in the ABA Banking Journal that the best first step for website compliance is to adopt and utilize WCAG 2.0 AA (website accessibility standard) as it has been incorporated into DOJ’s settlement agreements, and used in enforcement actions. The standard seeks to ensure that people with disabilities can access online information by providing coding guidelines to assist website developers in crafting accessible websites.

For touchscreen kiosks, there is no clear instructions on being fully compliant, but we know from experience and from others in our industry as noted in this article “Meeting the ADA Compliance Challenge” that giving the phycial reachability of the kiosk consideration is a minimum accommodation. From there, efforts to be ADA and Section 508 compliant (acceptable for use by the federal government), vendors must use guidelines self-adapted from sources that include; web standards like WCAG, settlements examples like Redbox’s DVD Rental Kiosk Class Action Settlement, and some of the more specific standards the ADA outlines for ATMs, fare vending machines, vending machines and fuel dispensers. In the article “Is that kiosk ADA compliant? Who knows?”

“For example, if an ATM offers additional functionalities such as coupon dispensing, ticket sales or statement printing, all such functions must be available to customers via speech output.”

Wondering about mobile applications? Good thinking; while there is no indication from DOJ as to what an accessible mobile application entails, we know from the ABA Bank Journal article that “…the DOJ mentioned mobile apps when it intervened in the National Federation of the Blind’s lawsuit against H&R Block in 2013, noting that the tax preparation company’s mobile apps precluded individuals with disabilities from having equal access to H&R Block goods and services, an indication that mobile apps are on the agency’s enforcement radar.”

If you are a legal beagle and want a page turner, check out “Websites, Kiosks, and Other Self-Service Equipment in Franchising: Legal Pitfalls Posed by Title III of the Americans with Disabilities Act” by Minh N. Vu and Julia N. Sarnoff.

As a result of the new legal risks our customers face, Kiosk & Display is changing the way we work by asking new questions such as, “Does your website already have ADA accommodations that will need to be supported on your kiosk?” and, “How heavily integrated (business dependent) will your desired kiosk be?”

While the legal and related political dust rises surrounding “cased” ADA Lawsuits, we are helping kiosk owners, who may have chosen to develop kiosks short of full ADA requirements, retrofit existing touchscreens with accommodations for wheelchair accessibility, audio support for screen readers, zoomtext support and in some cases Braille button solutions for the visually impaired. Some of these solutions can be expensive when retrofitted, so we know the stakes are high.

We would advise any financial institutions and at-risk businesses to make any reasonably affordable progress to create better ADA accommodations and reduce risk based on the affordability to their business. For those with existing touchscreen kiosks this may mean spending money on accommodations like those listed above, while for others it may mean providing alternate means of access.

While there is no way to know if these accommodations would afford full protection in court, we do know from this CU Podcast “Why ADA Website Lawsuits Toward CUs Going from Bad to Worse…” , that Domino’s Pizza was given some relief from litigation because they had provided a path for disabled customers who might have trouble with their site. So if nothing else is reasonably affordable to your business, consider placing an ADA compliant Braille sign on your touchscreen saying “If you are having problems using this touchscreen kiosk, please ask a staff member for assistance or call 800-xxx-xxxx for help.” This would make it clear that there is a procedure to provide alternative access to the information while in the business location and may reduce your overall risk. Please note, even though it might reduce your risk, it will not remove future obligation for compliance if your ability to afford accommodations increases over time.

Have a question about making your technology more accessible? We are happy to help you evaluate your options. Make an appointment with us today.

Leave a Reply